Multiple Choice

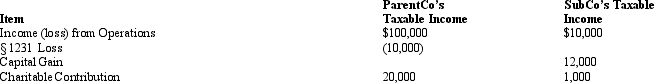

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

A) $81,000 $21,000

B) $81,000 $22,000

C) $70,000 $22,000

D) $70,000 $21,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: When a member departs a consolidated group,it

Q8: ParentCo purchased 100% of SubCo's stock on

Q13: ParentCo and SubCo had the following items

Q26: The "SRLY" and § 382 limitation rules

Q52: A subsidiary corporation must leave the consolidated

Q54: Consider AB, a brother-sister group of U.S.

Q88: The calendar year Sterling Group files its

Q89: ParentCo's separate taxable income was $200,000, and

Q103: If there is a balance in the

Q135: The rules for computing Federal consolidated taxable