Multiple Choice

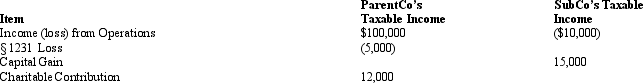

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $81,000.

B) $88,000.

C) $90,000.

D) $90,500.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: When a corporate group elects to file

Q17: In computing consolidated taxable income, the purchase

Q24: A Federal consolidated group can claim a

Q64: When a subsidiary sells to the parent

Q67: The Parent consolidated group reports the following

Q74: Except for the § 199 domestic production

Q75: The U.S.states apply different rules in treating

Q77: A corporation organized outside of the U.S.can

Q110: In computing consolidated taxable income, the profit/loss

Q128: One of the motivations for the consolidated