Essay

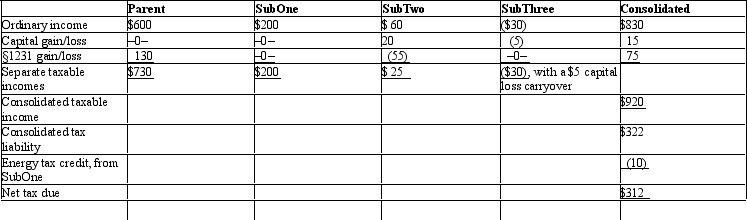

The Parent consolidated group reports the following results for the tax year.Determine each member's share of the consolidated tax liability,assuming that the members all have consented to use the relative taxable income tax-sharing method.Dollar amounts are listed in millions,and a 35% marginal income tax rate applies to all of the entities.

Correct Answer:

Verified

Consolidated tax lia...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: ParentCo's separate taxable income was $200,000, and

Q14: When a corporate group elects to file

Q17: In computing consolidated taxable income, the purchase

Q38: Consolidated group members each are jointly and

Q63: The starting point in computing consolidated taxable

Q72: ParentCo and SubCo had the following items

Q84: Dividends paid out of a subsidiary's E

Q110: In computing consolidated taxable income, the profit/loss

Q113: In computing consolidated taxable income, capital gains

Q128: One of the motivations for the consolidated