Essay

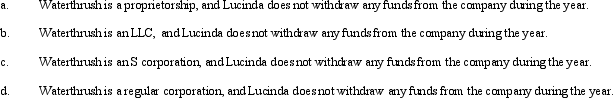

During the current year,Waterthrush Company had operating income of $510,000 and operating expenses of $400,000.In addition,Waterthrush had a long-term capital gain of $30,000.How does Lucinda,the sole owner of Waterthrush Company,report this information on her individual income tax return under following assumptions?

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Lilac Corporation incurred $4,700 of legal and

Q21: What is a limited liability company? What

Q51: Azul Corporation, a calendar year C corporation,

Q52: Francisco is the sole owner of Rose

Q61: During the current year, Thrasher, Inc., a

Q63: Eagle Corporation owns stock in Hawk Corporation

Q91: Patrick,an attorney,is the sole shareholder of Gander

Q93: During the current year,Coyote Corporation (a calendar

Q97: During the current year,Shrike Company had $220,000

Q99: During the current year,Lavender Corporation,a C corporation