Essay

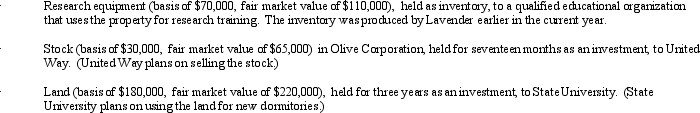

During the current year,Lavender Corporation,a C corporation in the business of manufacturing tangible research equipment,made charitable contributions to qualified organizations as follows:

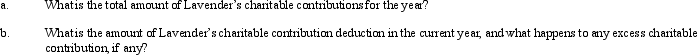

Lavender Corporation's taxable income (before any charitable contribution deduction)is $2.5 million.

Lavender Corporation's taxable income (before any charitable contribution deduction)is $2.5 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Discuss the purpose of Schedule M-1.Give two

Q21: What is a limited liability company? What

Q21: Norma formed Hyacinth Enterprises, a proprietorship, in

Q51: Azul Corporation, a calendar year C corporation,

Q61: During the current year, Thrasher, Inc., a

Q63: Eagle Corporation owns stock in Hawk Corporation

Q95: During the current year,Waterthrush Company had operating

Q97: During the current year,Shrike Company had $220,000

Q102: Almond Corporation, a calendar year C corporation,

Q103: Warbler Corporation,an accrual method regular corporation,was formed