Essay

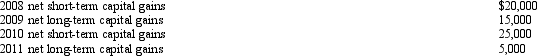

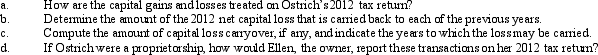

Ostrich,a C corporation,has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2012.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Quail Corporation is a C corporation with

Q33: Flycatcher Corporation, a C corporation, has two

Q48: A personal service corporation with taxable income

Q53: Tomas owns a sole proprietorship, and Lucy

Q66: Compare the basic tax and nontax factors

Q72: During the current year,Kingbird Corporation (a calendar

Q77: Which of the following statements is incorrect

Q101: Rose is a 50% partner in Wren

Q110: Schedule M-2 is used to reconcile unappropriated

Q116: Because of the taxable income limitation, no