Essay

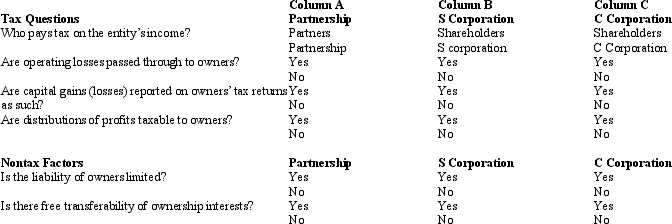

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The correc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q23: Quail Corporation is a C corporation with

Q33: Flycatcher Corporation, a C corporation, has two

Q53: Tomas owns a sole proprietorship, and Lucy

Q55: Eagle Company, a partnership, had a short-term

Q63: Jason,an architect,is the sole shareholder of Purple

Q69: Ostrich,a C corporation,has a net short-term capital

Q75: Jade Corporation, a C corporation, had $100,000

Q101: Rose is a 50% partner in Wren

Q110: Schedule M-2 is used to reconcile unappropriated

Q116: Because of the taxable income limitation, no