Essay

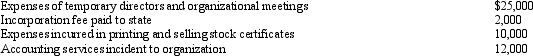

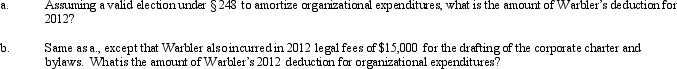

Warbler Corporation,an accrual method regular corporation,was formed and began operations on March 1,2012.The following expenses were incurred during its first year of operations (March 1 - December 31,2012):

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Discuss the purpose of Schedule M-1.Give two

Q18: Hippo, Inc., a calendar year C corporation,

Q21: Norma formed Hyacinth Enterprises, a proprietorship, in

Q21: What is a limited liability company? What

Q24: Schedule M-1 of Form 1120 is used

Q30: The corporate marginal income tax rates range

Q58: What is the annual required estimated tax

Q63: Eagle Corporation owns stock in Hawk Corporation

Q99: During the current year,Lavender Corporation,a C corporation

Q102: Almond Corporation, a calendar year C corporation,