Essay

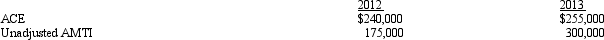

Duck,Inc. ,is a C corporation that is not eligible for the small business exception to the AMT.Its adjusted current earnings (ACE)and unadjusted alternative minimum taxable income (unadjusted AMTI)for 2012 and 2013 are as follows:

Calculate the amount of the ACE adjustment for 2012 and 2013.

Calculate the amount of the ACE adjustment for 2012 and 2013.

Correct Answer:

Verified

For 2012,there is a positive ACE adjustm...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Section 1244 ordinary loss treatment is available

Q38: To the extent of built-in gain or

Q53: A C corporation offers greater flexibility in

Q89: Kirby,the sole shareholder of Falcon,Inc. ,leases a

Q90: Nick owns 60% of the Agate Company

Q92: Gladys contributes land with an adjusted basis

Q94: Alanna contributes property with an adjusted basis

Q96: From the perspective of the seller of

Q112: Under what circumstances, if any, do the

Q129: Which of the following statements is incorrect?<br>A)