Essay

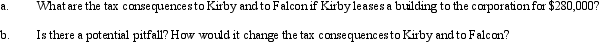

Kirby,the sole shareholder of Falcon,Inc. ,leases a building to the corporation.The taxable income of the corporation for 2012,before deducting the lease payments,is projected to be $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: Section 1244 ordinary loss treatment is available

Q38: To the extent of built-in gain or

Q53: A C corporation offers greater flexibility in

Q84: Eagle,Inc.recognizes that it may have an accumulated

Q85: Albert and Elva each own 50% of

Q90: Nick owns 60% of the Agate Company

Q91: Duck,Inc. ,is a C corporation that is

Q92: Gladys contributes land with an adjusted basis

Q94: Alanna contributes property with an adjusted basis

Q129: Which of the following statements is incorrect?<br>A)