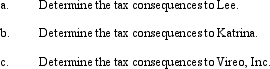

Essay

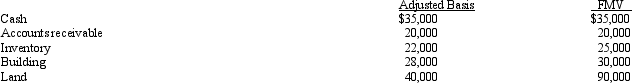

Lee owns all the stock of Vireo,Inc. ,a C corporation for which he has an adjusted basis of $150,000.The assets of Vireo,Inc. ,are as follows:

Lee sells his stock to Katrina for $300,000.

Lee sells his stock to Katrina for $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q50: Melinda's basis for her partnership interest is

Q61: With respect to special allocations, is the

Q98: Malcomb and Sandra (shareholders) each loan Crow

Q114: Which of the following statements is correct?<br>A)

Q129: An effective way for all C corporations

Q134: Trolette contributes property with an adjusted basis

Q135: In its first year of operations,a corporation

Q137: Which of the following business entity forms

Q138: Nontax factors are less important than tax

Q140: Barb and Chuck each have a 50%