Essay

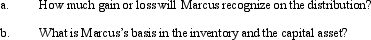

In a proportionate liquidating distribution in which the partnership is liquidated,Marcus received cash of $60,000,inventory (basis of $10,000,fair market value of $12,000),and a capital asset (basis and fair market value of $22,000).Immediately before the distribution,Marcus's basis in the partnership interest was $100,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Megan's basis was $100,000 in the MAR

Q27: In a proportionate liquidating distribution, Sara receives

Q61: Which of the following distributions would never

Q63: The December 31,2012,balance sheet of the BCD

Q64: The December 31,2012 balance sheet of GRT

Q70: A payment to a retiring general partner

Q115: Susan is a one-fourth limited partner in

Q124: Zach's partnership interest basis is $80,000.Zach receives

Q149: Lori, a partner in the JKL partnership,

Q175: For Federal income tax purposes, a distribution