Multiple Choice

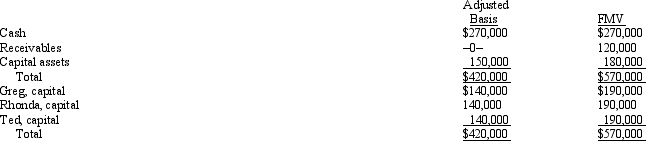

The December 31,2012 balance sheet of GRT Services,LLP reads as follows:  The partners share equally in partnership capital,income,gain,loss,deduction,and credit.Capital is not a material income-producing factor to the partnership,and all partners are active in the business.On December 31,2012,general partner Ronda receives a distribution of $190,000 cash in liquidation of her partnership interest under § 736.Ronda's outside basis for the partnership interest immediately before the distribution is $140,000.How much is Ronda's gain or loss on the distribution and what is its character?

The partners share equally in partnership capital,income,gain,loss,deduction,and credit.Capital is not a material income-producing factor to the partnership,and all partners are active in the business.On December 31,2012,general partner Ronda receives a distribution of $190,000 cash in liquidation of her partnership interest under § 736.Ronda's outside basis for the partnership interest immediately before the distribution is $140,000.How much is Ronda's gain or loss on the distribution and what is its character?

A) $50,000 ordinary income.

B) $40,000 ordinary income;$10,000 capital gain.

C) $40,000 capital gain;$10,000 ordinary income.

D) $50,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Megan's basis was $100,000 in the MAR

Q17: In a proportionate nonliquidating distribution of cash

Q27: In a proportionate liquidating distribution, Sara receives

Q37: Aaron owns a 30% interest in a

Q60: Your client has operated a sole proprietorship

Q63: The December 31,2012,balance sheet of the BCD

Q68: In a proportionate liquidating distribution in which

Q124: Zach's partnership interest basis is $80,000.Zach receives

Q149: Lori, a partner in the JKL partnership,

Q159: Suzy owns a 30% interest in the