Essay

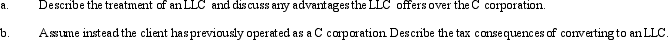

Your client has operated a sole proprietorship for several years,and is now interested in raising capital for expansion.He is considering forming either a C corporation or an LLC.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Andrew receives a proportionate nonliquidating distribution from

Q10: Matt receives a proportionate nonliquidating distribution.At the

Q16: Megan's basis was $100,000 in the MAR

Q17: In a proportionate nonliquidating distribution of cash

Q37: Aaron owns a 30% interest in a

Q57: Cindy,a 20% general partner in the CDE

Q63: The December 31,2012,balance sheet of the BCD

Q64: The December 31,2012 balance sheet of GRT

Q126: In a proportionate liquidating distribution, UVW Partnership

Q159: Suzy owns a 30% interest in the