Multiple Choice

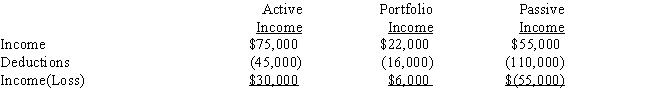

If a taxpayer has the following for the current year:

I.If the taxpayer is a regular corporation,taxable income from the three activities is a loss of $19,000.

II.If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant,taxable income is $11,000.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Match each statement with the correct term

Q30: Match the term with the correct response.More

Q30: Fowler sells stock he had purchased for

Q38: Match each statement with the correct term

Q53: Barry owns all of the stock of

Q68: Ling owns 3 passive investments.During the last

Q69: During the current year,Cathy realizes <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2038/.jpg"

Q105: Match each statement with the correct term

Q107: Darien owns a passive activity that has

Q110: During the current year, Diane disposes of