Multiple Choice

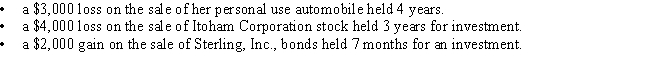

During the current year,Cathy realizes  Determine the tax consequences of these events.

Determine the tax consequences of these events.

A) Cathy deducts a $5,000 net capital loss.

B) Cathy deducts a $3,000 net capital loss.

C) Cathy deducts a $2,000 net capital loss.

D) Cathy deducts a $1,000 net capital loss.

E) Cathy deducts a $7,000 net capital loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Match the term with the correct response.More

Q38: Match each statement with the correct term

Q66: Bowden is a single individual and has

Q68: Ling owns 3 passive investments.During the last

Q73: If a taxpayer has the following for

Q78: Roscoe and Amy are married and own

Q105: Match each statement with the correct term

Q110: During the current year, Diane disposes of

Q123: Match each statement with the correct term

Q127: Portfolio income consists of unearned income from