Multiple Choice

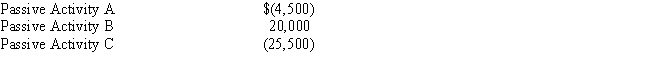

Linda owns three passive activities that had the following results for the current year:

If none of the passive activities are rental real estate activities,what is the amount of suspended loss attributable to Activity A?

A) $- 0 -

B) $ 1,500

C) $ 4,500

D) $ 8,500

E) $10,000

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Sylvia owns 1,000 shares of Sidney Sails,Inc.,for

Q45: Match each statement with the correct term

Q46: Virginia owns a business that rents power

Q84: Melinda and Riley are married taxpayers. During

Q91: Maria, an engineer, has adjusted gross income

Q97: During the year,Shipra's apartment is burglarized and

Q98: Gloria owns 750 shares of the Greene

Q102: A transaction loss occurs when an asset

Q115: Salvador owns a passive activity that has

Q118: Match each statement with the correct term