Short Answer

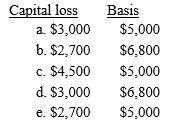

Sylvia owns 1,000 shares of Sidney Sails,Inc.,for which she paid $18,000 several years ago.On March 15,she purchases 400 additional shares for $5,000.Sylvia sells the original 1,000 shares for $13,500 on April 1.These are her only stock transactions during the year.Sylvia's capital loss deduction for the current year and her basis in the new shares are:

Correct Answer:

Verified

Correct Answer:

Verified

Q15: All of the following are capital assets,

Q35: Linda owns three passive activities that had

Q37: Anna owns a passive activity that has

Q43: A taxpayer had the following for the

Q46: Virginia owns a business that rents power

Q67: A closely held corporation cannot offset net

Q74: Ricardo owns interests in 3 passive activities:

Q91: Maria, an engineer, has adjusted gross income

Q102: A transaction loss occurs when an asset

Q118: Match each statement with the correct term