Multiple Choice

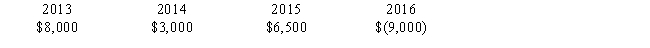

Billingsworth Corporation has the following net capital gains and losses for 2013 through 2016.Billingsworth' marginal tax rate is 34% for all years.

In 2016,Billingsworth Corporation earned net operating income of $30,000.What is/are the tax effect(s) of the $9,000 net capital loss in 2016?

I.Corporate taxable income is $21,000.

II.The net capital loss will provide income tax refunds totaling $3,060.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: During the current year, Alyssa incurred a

Q15: All of the following are capital assets,

Q43: A taxpayer had the following for the

Q51: A taxpayer has the following income (losses)for

Q53: Which of the following events is a

Q64: "Active participation" and "real estate professional" are

Q67: A closely held corporation cannot offset net

Q74: Ricardo owns interests in 3 passive activities:

Q76: During the year, Aimee reports $30,000 of

Q113: Leon is allowed to deduct all the