Multiple Choice

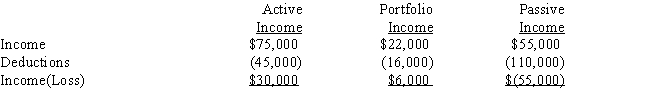

A taxpayer had the following for the current year:

I.If the taxpayer is a closely held corporation,taxable income from the three activities is income of $6,000.

II.If the taxpayer is an individual and the passive income is not related to a rental real estate activity,taxable income is $36,000.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: During the current year, Alyssa incurred a

Q15: All of the following are capital assets,

Q37: Anna owns a passive activity that has

Q40: Sylvia owns 1,000 shares of Sidney Sails,Inc.,for

Q47: Billingsworth Corporation has the following net capital

Q64: "Active participation" and "real estate professional" are

Q67: A closely held corporation cannot offset net

Q74: Ricardo owns interests in 3 passive activities:

Q91: Maria, an engineer, has adjusted gross income

Q118: Match each statement with the correct term