Essay

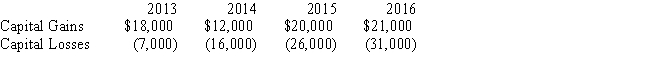

The Corinth Corporation is incorporated in 2013 and had no capital asset transactions during the year.From 2013 through 2016,the company had the following capital gains and losses:

If Corinth's marginal tax rate during each of these years is 34%,what is the effect of Corinth's capital gains and losses on the amount of tax due each year?

Correct Answer:

Verified

The gains and losses must be netted toge...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Jennifer's business storage shed is damaged by

Q19: During the year, Daniel sells both of

Q32: For each of the following situations, determine

Q48: Aunt Bea sold some stock she purchased

Q56: Match each statement with the correct term

Q57: If a corporation incurs a net operating

Q62: Ford's automobile that he uses 100% for

Q86: Carmen purchased a business for $150,000 by

Q109: Match each statement with the correct term

Q119: Lisa sells some stock she purchased several