Essay

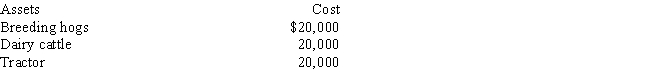

Determine the MACRS cost recovery deductions for 2016 and 2017 on the following assets that were purchased for use in a farming business on July 15,2016.The taxpayer does not wish to use the Section 179 election.

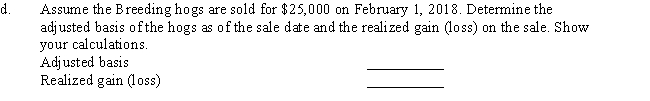

a.Breeding hogs depreciation:Total 2016 Breeding hogs Cost Recovery Deduction (show your calculations)Total 2017 Breeding hogs Cost Recovery Deduction (show your calculations)

b.Dairy cattle depreciation:Total 2016 Dairy Cattle Cost Recovery Deduction (show your calculations)Total 2017 Dairy Cattle Cost Recovery Deduction (show your calculations)

c.Tractor depreciation:Total 2016 Tractor Cost Recovery Deduction (show your calculations)Total 2017 Tractor Cost Recovery Deduction (show your calculations)

Correct Answer:

Verified

Total 2016 Breeding hogs Cost Recover...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Total 2016 Breeding hogs Cost Recover...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Kuo Corporation uses the following assets in

Q33: Match each statement with the correct term

Q33: Charles purchases an interest in a uranium

Q36: Which of the following statements related to

Q41: The mid-quarter convention under MACRS provides that<br>A)Depreciation

Q47: Why might a taxpayer elect to depreciate

Q50: MACRS requires the use of one of

Q53: Which of the following assets would be

Q76: The Section 179 election promotes which of

Q80: Mike purchases a computer (5-year property)for $3,000