Essay

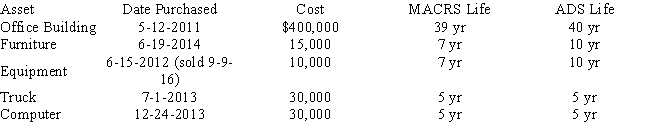

Kuo Corporation uses the following assets in its business in 2016:

Assume Kuo Corporation does not utilize Sec 179 expense,has not disposed of any asset since 2002,and has never expensed an asset previously.The equipment was sold on 9-9-16 for $4,000.

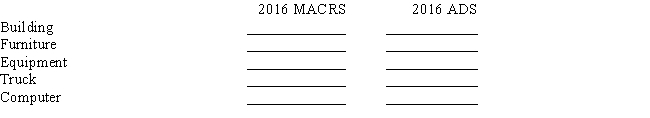

What is Kuo's 2016 depreciation expense using MACRS and for ADS?

Correct Answer:

Verified

*mid-quarter convention used ...

*mid-quarter convention used ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Sophia purchases a completely furnished condominium in

Q19: During 2016,Duncan Company purchases and places in

Q20: In 2016,Oscar purchases $2,150,000 of equipment.The taxable

Q21: On March 23,2016,Saturn Investments Corporation purchases a

Q22: Wellington Apartments purchases an apartment building on

Q28: Determine the MACRS cost recovery deductions for

Q33: Match each statement with the correct term

Q41: The mid-quarter convention under MACRS provides that<br>A)Depreciation

Q53: Which of the following assets would be

Q80: Mike purchases a computer (5-year property)for $3,000