Essay

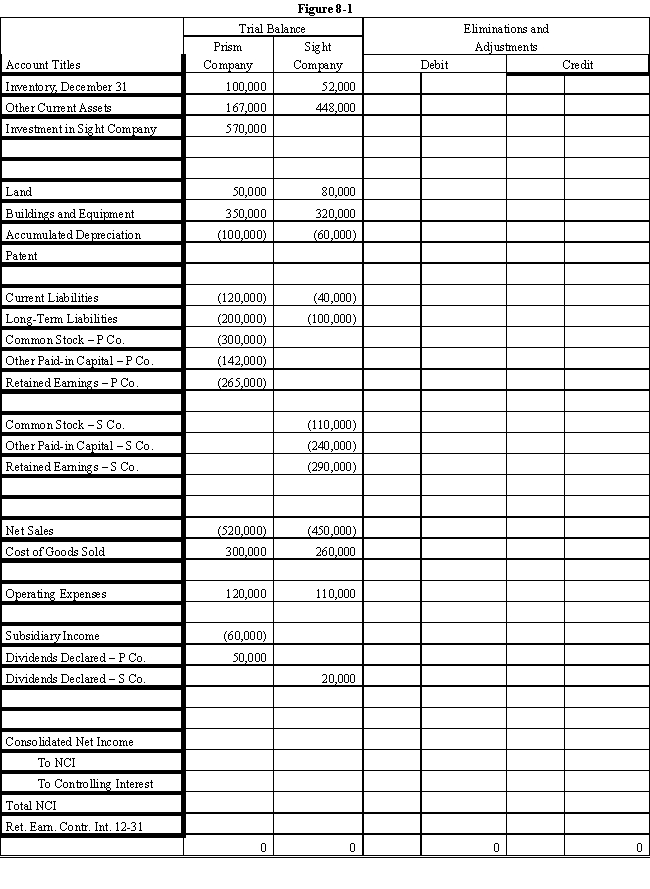

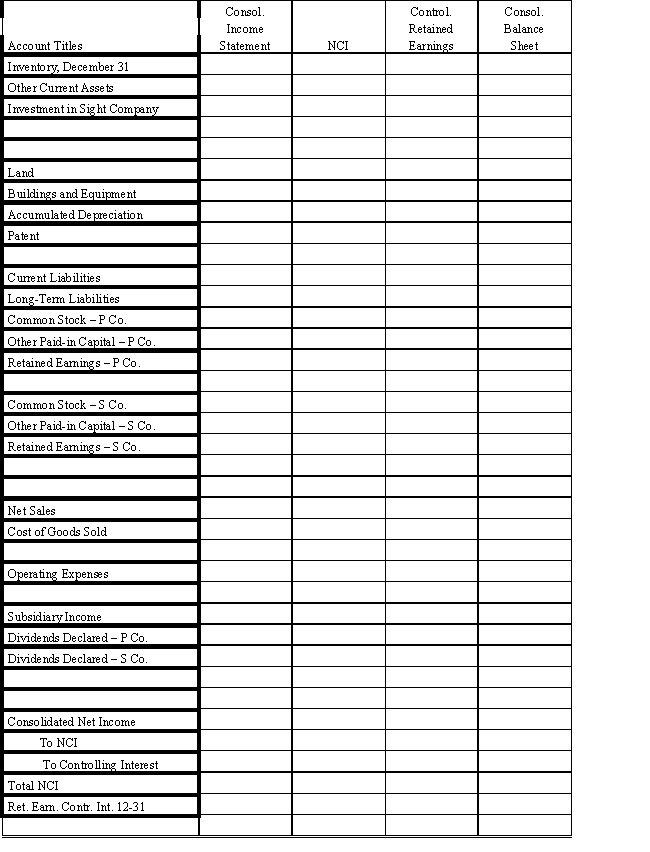

On January 1, 2016, Prism Company purchased 7,500 shares of the common stock of Sight Company for $495,000.On this date, Sight had 20,000 shares of $10 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $200,000 and $300,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.

?

Sight's net income and dividends for two years were:

?

?

In November 2016, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share.The stock dividend was distributed on December 31, 2016.

?

For both 2016 and 2017, Prism Company has accounted for its investment in Sight Company using the simple equity method.

?

During 2016, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 2016.During 2017, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 2017.Sight's gross profit on intercompany sales is 40%.

?

Required:

?

Complete the Figure 8-1 worksheet for consolidated financial statements for 2017.

?

?

?

?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: On 1/1/16 Poncho acquired an 80%

Q3: On January 1, 2016, Paul, Inc.acquired

Q4: Company P purchased an 80% interest

Q5: Pepper Company owns 60,000 of Salt Company's

Q6: On January 1, 2016, Parent Company purchased

Q7: Manke Company owns a 90% interest in

Q8: Apple Inc.purchased a 70% interest in

Q9: Pepper Company owned 60,000 of Salt

Q10: Consolidated statements for X, Y, and Z

Q11: Parrot, Inc.purchased a 60% interest in