Essay

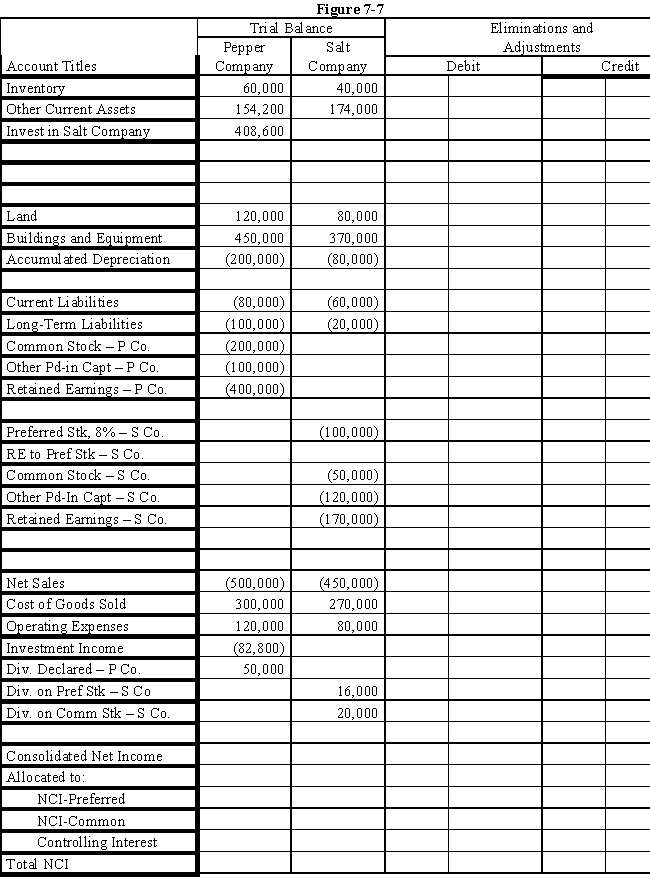

On January 1, 2016, Pepper Company purchased 90% of the common stock of Salt Company for $360,000 when Salt had total shareholders' equity as follows:

?

?

Any excess of cost over book value on this date is attributed to a patent, to be amortized over 10 years.The 8% preferred stock is cumulative, non-participating, and has a liquidating value of par plus dividends in arrears.There were no preferred dividends in arrears on January 1, 2016.Pepper elected to account for its investment in Salt using the simple equity method.

?

During 2016, Salt had a net loss of $10,000 and paid no dividends.In 2017, Salt had net income of $100,000 and paid dividends totaling $36,000.

?

During 2017, Salt sold merchandise to Pepper for $40,000, of which $20,000 is still held by Pepper on December 31, 2017.Salt's usual gross profit is 40%.

?

Required:

?

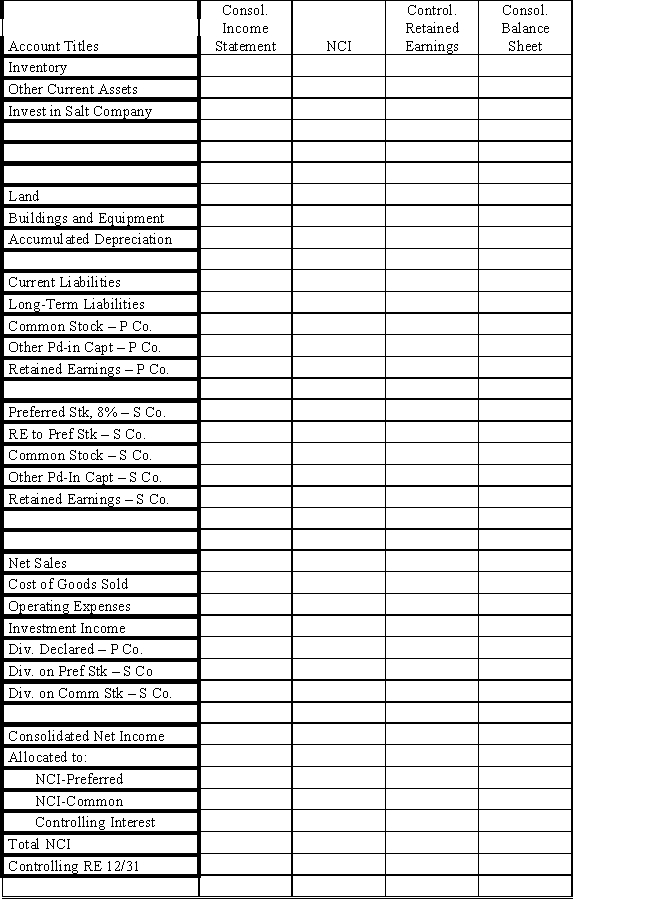

Complete the Figure 7-7 worksheet for consolidated financial statements for the year ended December 31, 2017.

?

?

Correct Answer:

Verified

Answer 7-7.

?

?

?

?

Eliminations and A...

Eliminations and A...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Pilatte Company acquired a 90% interest

Q33: Parent has purchased additional shares of subsidiary

Q34: On January 1, 2016, Poplar Company acquired

Q35: Which of the following statements is incorrect

Q36: Plant Company owns 80% of the common

Q37: Control of a subsidiary was achieved with

Q38: A new subsidiary is being formed.The parent

Q39: A subsidiary company may have preferred stock

Q40: Page Company purchased an 80% interest

Q41: Saddle Corporation is an 80%-owned subsidiary of