Essay

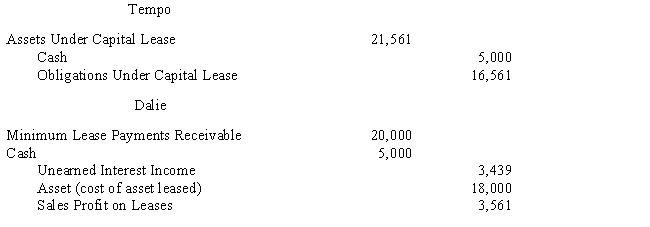

Tempo Industries is an 80%-owned subsidiary of Dalie Inc.On January 1, 2017, Dalie leased an asset to Tempo and the following journal entries were made:

?

?

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year.The implicit interest rate used by both Dalie and Tempo is 8%.

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year.The implicit interest rate used by both Dalie and Tempo is 8%.

?

Required:

?

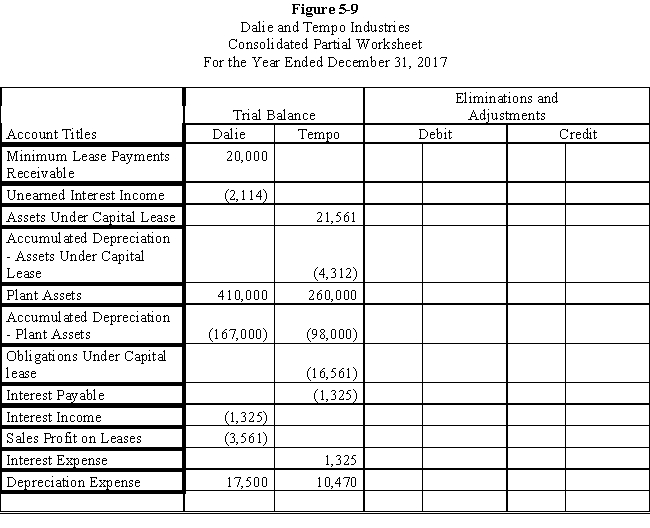

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-9 partial worksheet of December 31, 2017.Key and explain all eliminations and adjustments.

?

?

Correct Answer:

Verified

Answer 5-9.

?

?

Eliminations and Adjus...

Eliminations and Adjus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Smart Corporation is a 90%-owned subsidiary of

Q22: On January 1, 2016, Parent Company acquired

Q23: Phil Company leased a machine to its

Q24: What is recorded by the lessee and

Q25: On January 1, 2016, Pope Company acquired

Q27: Which of the following statements is true?<br>A)No

Q28: On an income distribution schedule, any gain

Q29: On January 1, 2016, Parent Company

Q30: Company S is a 100%-owned subsidiary of

Q31: The effect of an operating lease on