Essay

On January 1, 2016, Parent Company acquired 100% of the common stock of Subsidiary Company for $365,000.On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively.Any excess of cost over book value is due to goodwill.Parent uses the simple equity method to account for its investment in subsidiary.

?

On January 1, 2017, Parent purchased equipment for $174,120 and immediately leased the equipment to Subsidiary on a 4-year lease.The transaction was legally structured as a sales-type lease with a present value for the minimum lease payments of $204,120.Parent recorded the following entry:

?

?

The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments.The implicit interest rate is 12%.The lease provides for an automatic transfer of title at the end of 4 years.The estimated useful life of the equipment is 6 years.The lease has been capitalized by both companies.

?

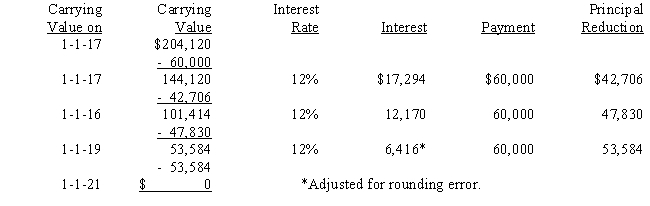

A lease amortization schedule, applicable to either company, is presented below:

?

?

Required:

Required:

?

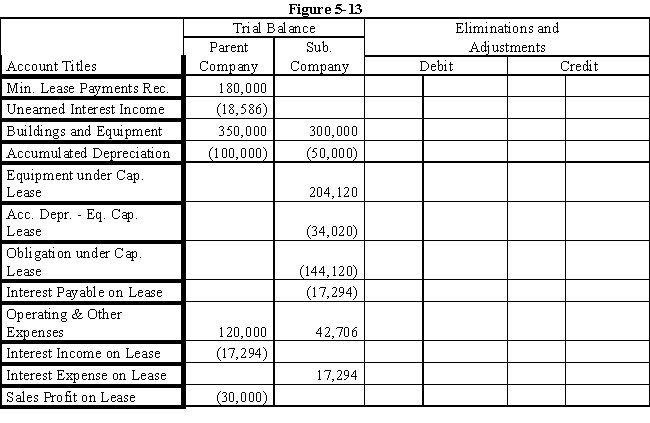

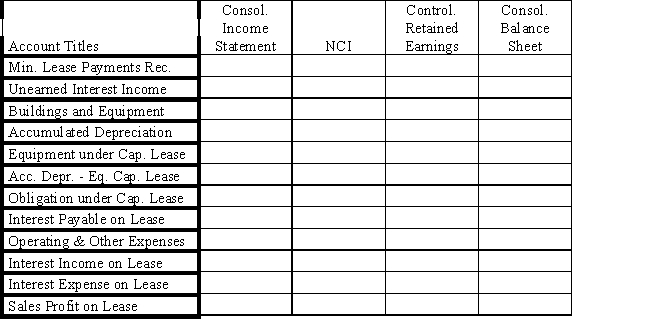

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-13 partial worksheet as of December 31, 2017.Key and explain all eliminations and adjustments.

?

?

Correct Answer:

Verified

Answer 5-13.

?

?

?...

?...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

?

?

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: What is recorded by the lessee and

Q25: On January 1, 2016, Pope Company acquired

Q26: Tempo Industries is an 80%-owned subsidiary of

Q27: Which of the following statements is true?<br>A)No

Q28: On an income distribution schedule, any gain

Q30: Company S is a 100%-owned subsidiary of

Q31: The effect of an operating lease on

Q32: Company S is a 100%-owned subsidiary of

Q33: Company S is a 100%-owned subsidiary of

Q34: Lease terms can be considered to be