Multiple Choice

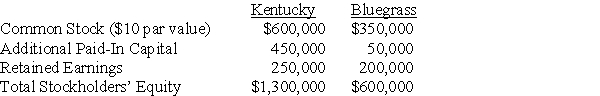

On January 2, 20X2, Kentucky Company acquired 70% of Bluegrass Corporation's common stock for $420,000 cash. At the acquisition date, the book values and fair values of Bluegrass' assets and liabilities were equal, and the fair value of the noncontrolling interest was equal to 30% of the total book value of Bluegrass. The stockholders' equity accounts of the two companies at the acquisition date are as follows:

Noncontrolling interest was assigned income of $15,000 in Kentucky's consolidated income statement for 20X2.

Noncontrolling interest was assigned income of $15,000 in Kentucky's consolidated income statement for 20X2.

-Based on the preceding information,what will be the amount of net income reported by Bluegrass Corporation in 20X2?

A) $45,000

B) $50,000

C) $75,000

D) $105,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: ASC 805 is related to the Consolidation

Q6: On January 1,20X8,Potter Corporation acquired 90 percent

Q8: Which of the following usually does not

Q30: On January 2,20X2,Piranha Company acquired 70 percent

Q43: Pepper Company acquired 60 percent of the

Q44: Silver Company owns 60 percent of the

Q45: On January 3, 20X9, Redding Company acquired

Q47: For a less-than-wholly-owned subsidiary,goodwill under the parent

Q48: On January 1, 20X9, Heathcliff Corporation acquired

Q49: Small-Town Retail owns 70 percent of Supplier