Multiple Choice

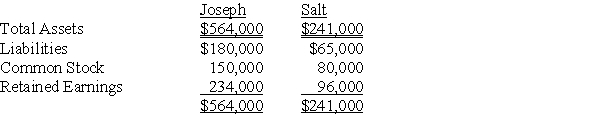

On January 1, 20X6, Joseph Company acquired 80% of Salt Company's outstanding stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Salt Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 20X6 are as follows:

-Based on the preceding information,what amount should be reported as noncontrolling interest in net assets in Joseph Company's December 31,20X6,consolidated balance sheet?

A) $35,200

B) $48,200

C) $76,800

D) $112,800

Correct Answer:

Verified

Correct Answer:

Verified

Q2: On January 1, 20X6, Joseph Company acquired

Q4: Zeta Corporation and its subsidiary reported consolidated

Q6: On January 1,20X8,Gregory Corporation acquired 90 percent

Q7: On January 3, 20X9, Jane Company acquired

Q9: Parent Company acquired 90% of Son Inc.on

Q10: On January 3,20X9,Pleat Company acquired 80 percent

Q17: In reading a set of consolidated financial

Q19: Maple Corporation and its subsidiary reported consolidated

Q29: On January 1,20X8,Potter Corporation acquired 90 percent

Q33: For which of the following reporting units