Essay

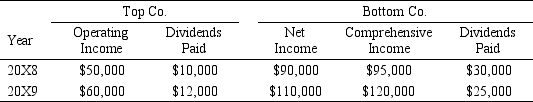

Top Corporation acquired 80 percent of Bottom Corporation's common stock on January 1,20X8,for $520,000.At that date,Bottom reported common stock outstanding of $250,000 and retained earnings of $375,000.Assume the fair value of the noncontrolling interest on January 1,20X8 was $130,000.The book values and fair values of Bottom's assets and liabilities were equal on the acquisition date,except for other intangible assets,which had a fair value $25,000 greater than book value and a 5-year remaining life.Top and Bottom reported the following data for 20X8 and 20X9:

a.Compute consolidated comprehensive income for 20X8 and 20X9.

b.Compute comprehensive income attributable to the controlling interest for 20X8 and 20X9.

Problem 58 (continued):

Correct Answer:

Verified

Correct Answer:

Verified

Q3: On January 1,20X8,Package Company acquired 80 percent

Q7: Based on the preceding information,what amount of

Q9: The following information applies to Questions 21-26<br>On

Q11: The following information applies to Questions 41-45<br>On

Q12: On January 1,20X8,Package Company acquired 80 percent

Q16: On January 1,20X6,Pumpkin Corporation acquired 70 percent

Q24: On January 1,20X8,Parsley Corporation acquired 75 percent

Q35: On January 1,20X6,Pumpkin Corporation acquired 70 percent

Q41: Postage Corporation acquired 75 percent of Stamp

Q49: On January 1,20X6,Pumpkin Corporation acquired 70 percent