Multiple Choice

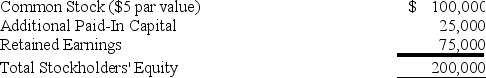

Pony Corporation acquired 90 percent of Saddle Corporation's common stock on September 30,20X8 for $225,000.At that date,the fair value of the noncontrolling interest was $25,000.On January 1,20X8,Saddle reported the following stockholders' equity balances:

Saddle reported net income of $80,000 in 20X8,earned uniformly throughout the year,and declared and paid dividends of $10,000 on June 30 and $30,000 on December 31,20X8.Pony reported retained earnings of $250,000 on January 1,20X8,and had 20X8 income of $120,000 from its separate operations.Pony paid dividends of $50,000 on December 31,20X8.Pony accounts for its investment in Saddle Corporation using the fully adjusted equity method.

Saddle reported net income of $80,000 in 20X8,earned uniformly throughout the year,and declared and paid dividends of $10,000 on June 30 and $30,000 on December 31,20X8.Pony reported retained earnings of $250,000 on January 1,20X8,and had 20X8 income of $120,000 from its separate operations.Pony paid dividends of $50,000 on December 31,20X8.Pony accounts for its investment in Saddle Corporation using the fully adjusted equity method.

-Based on the information provided,what is the consolidated income to the controlling interest reported for the year 20X8?

A) $192,000

B) $138,000

C) $140,000

D) $120,000

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Plywood Corporation's consolidated cash flow statement for

Q35: Pappas Company owns 85 percent of Sunny

Q36: Pure Life Corporation has just finished preparing

Q37: Pony Corporation acquired 90 percent of Saddle

Q38: On July 1,20X8,Pair Logic Corporation acquires 75

Q40: Pure Life Corporation has just finished preparing

Q41: The following information comes from Torveson Company's

Q42: Plush Corporation holds 80 percent of Scratch

Q43: Power Corporation's controller has just finished preparing

Q44: Peacoat Corporation acquired 80 percent of Sweater