Multiple Choice

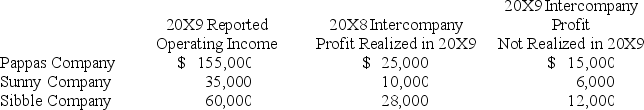

Pappas Company owns 85 percent of Sunny Company's stock and 80 percent of Sibble Company's stock.All acquisitions were made at book value.The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies.The companies file a consolidated tax return each year and in 20X9 paid a total tax of $112,000.Each company is involved in a number of intercompany inventory transfers each period.Information on the companies' activities for 20X9 is as follows:

Pappas Company does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Pappas Company does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

-Based on the information provided,what amount of income tax expense should be assigned to Sibble?

A) $24,000

B) $35,200

C) $19,200

D) $30,400

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Company P holds 70 percent of the

Q31: Power Corporation owns 75 percent of Transmitter

Q32: Pappas Company owns 85 percent of Sunny

Q33: Which of the following observations concerning the

Q34: Plywood Corporation's consolidated cash flow statement for

Q36: Pure Life Corporation has just finished preparing

Q37: Pony Corporation acquired 90 percent of Saddle

Q38: On July 1,20X8,Pair Logic Corporation acquires 75

Q39: Pony Corporation acquired 90 percent of Saddle

Q40: Pure Life Corporation has just finished preparing