Multiple Choice

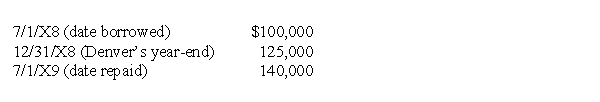

On November 1,20X8,Denver Company borrowed 500,000 local currency units (LCU) from a foreign lender evidenced by an interest-bearing note due on November 1,20X9,which is denominated in the currency of the lender.The U.S.dollar equivalent of the note principal was as follows:  In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?

In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?

A) 15,000 gain

B) 25,000 gain

C) 15,000 loss

D) 40,000 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Suppose the direct foreign exchange rates in

Q21: Taste Bits Inc. purchased chocolates from Switzerland

Q22: Highland Company sold goods to an Egyptian

Q23: On December 5, 20X8, Texas based Imperial

Q24: On September 1,20X1,Brady Corp.entered into a foreign

Q26: Tinitoys,Inc. ,a domestic company,purchased inventory from a

Q40: Suppose the direct foreign exchange rates in

Q43: Tinitoys,Inc. ,a domestic company,purchased inventory from a

Q47: If 1 British pound can be exchanged

Q48: On December 1,20X8,Hedge Company entered into a