Multiple Choice

On December 1,20X8,Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78.On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

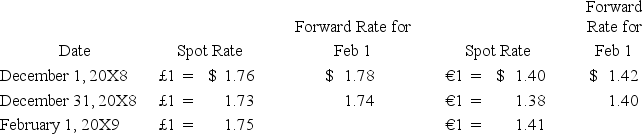

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

-Based on the preceding information,what is the effect of the British pound speculative contract on 20X8 net income?

A) $10,000 gain

B) $6,000 gain

C) $8,000 gain

D) $2,000 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Tinitoys,Inc. ,a domestic company,purchased inventory from a

Q44: Spiraling crude oil prices prompted AMAR Company

Q45: On December 5,20X8,Texas based Imperial Corporation purchased

Q46: On December 1,20X8,Hedge Company entered into a

Q47: If 1 British pound can be exchanged

Q49: Heavy Company sold metal scrap to a

Q50: Tinitoys,Inc. ,a domestic company,purchased inventory from a

Q51: On December 1,20X8,Hedge Company entered into a

Q52: Suppose the direct foreign exchange rates in

Q53: Levin company entered into a forward contract