Multiple Choice

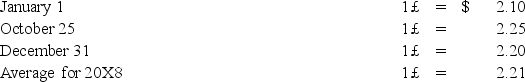

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1,20X8,for $1,100,000.The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition.On January 1,20X8,the book values of its identifiable assets and liabilities approximated their fair values.As a result of an analysis of functional currency indicators,Leo determined that the British pound was the functional currency.On December 31,20X8,the British subsidiary's adjusted trial balance,translated into U.S.dollars,contained $17,000 more debits than credits.The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25,20X8.Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds.Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount.Exchange rates at various dates during 20X8 follow:

-Based on the preceding information,what amount should Leo record as "income from subsidiary" based on the British subsidiary's reported net income?

A) $72,930

B) $52,500

C) $72,600

D) $69,300

Correct Answer:

Verified

Correct Answer:

Verified

Q38: The balance in Newsprint Corp.'s foreign exchange

Q39: Prepare a schedule providing a proof of

Q40: Which of the following describes a situation

Q41: Simon Company has two foreign subsidiaries.One is

Q42: On January 2,20X8,Polaris Company acquired a 100%

Q44: The balance in Newsprint Corp.'s foreign exchange

Q45: The gain or loss on the effective

Q46: Dover Company owns 90% of the capital

Q47: Seattle,Inc.owns an 80 percent interest in a

Q48: Dividends of a foreign subsidiary are translated