Multiple Choice

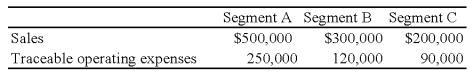

Trevor Company discloses supplementary operating segment information for its three reportable segments.Data for 20X8 are available as follows:  Allocable costs for the year was $180,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X8 operating profit for Segment B was:

Allocable costs for the year was $180,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X8 operating profit for Segment B was:

A) $110,000

B) $180,000

C) $126,000

D) $120,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Denver Company,a calendar-year corporation,had the following actual

Q13: All of the following are differences between

Q15: Iona Corporation is in the process of

Q16: Chicago Company,a calendar-year corporation,had the following actual

Q18: Collins Company reported consolidated revenue of $120,000,000

Q37: An analysis of Abbey Company's operating segments

Q41: FASB has specified a "75% percent consolidated

Q53: Estimated gross profit rates may be used

Q56: During the third quarter of 20X4,Ripley Company

Q57: Forge Company,a calendar-year entity,had 6,000 units in