Multiple Choice

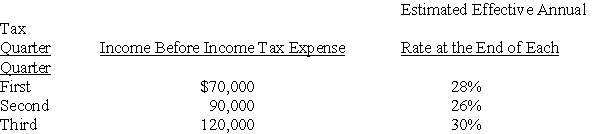

Chicago Company,a calendar-year corporation,had the following actual income before income tax expense and estimated effective annual income tax rates for the first three quarters in 20X2:

Chicago's income tax expense in its interim income statement for the third quarter should be

A) $36,000

B) $41,000

C) $42,400

D) $84,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Denver Company,a calendar-year corporation,had the following actual

Q13: All of the following are differences between

Q14: Trevor Company discloses supplementary operating segment information

Q15: Iona Corporation is in the process of

Q18: Collins Company reported consolidated revenue of $120,000,000

Q20: Grum Corp.,a publicly-owned corporation,is subject to the

Q21: Ridge Company is in the process of

Q37: An analysis of Abbey Company's operating segments

Q53: Estimated gross profit rates may be used

Q57: Forge Company,a calendar-year entity,had 6,000 units in