Multiple Choice

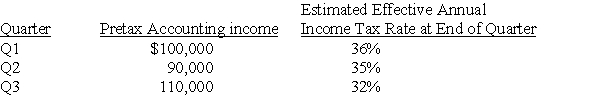

Daniel Corporation,which has a fiscal year ending December 31,had the following pretax accounting income and estimated effective annual income tax rates for the first three quarters of the year ended December 31,20X6:

Daniel's income tax expense in its interim income statement for the third quarter is

A) $29,500

B) $35,200

C) $66,500

D) $96,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: How would a company report a change

Q18: Forge Company,a calendar-year entity,had 6,000 units in

Q44: On June 30,20X8,String Corporation incurred a $220,000

Q61: Wakefield Company uses a perpetual inventory system.In

Q66: Trevor Company discloses supplementary operating segment information

Q67: Tecumseh Co.(Tecumseh),a publicly owned corporation,assesses performance and

Q69: Mason Company paid its annual property taxes

Q70: Operand Corporation reported consolidated revenues of $30,000,000

Q74: Cherokee Company reported consolidated revenue of $90,000,000

Q75: Tuttle Company discloses supplementary operating segment information