Multiple Choice

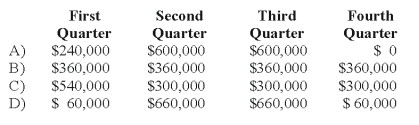

Mason Company paid its annual property taxes of $240,000 on February 15,20X9.Mason also anticipates that its annual repairs expense for 20X9 will be $1,200,000.This amount is usually incurred and paid in July and August when operations are shut down so that machinery and equipment can be repaired.What amount should Mason deduct for property taxes and repairs in each quarter for 20X9?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Fisher Company pays its executives a bonus

Q7: How would a company report a change

Q18: Forge Company,a calendar-year entity,had 6,000 units in

Q61: Wakefield Company uses a perpetual inventory system.In

Q65: The following information pertains to Aria Co.(Aria)and

Q66: Trevor Company discloses supplementary operating segment information

Q67: Tecumseh Co.(Tecumseh),a publicly owned corporation,assesses performance and

Q70: Operand Corporation reported consolidated revenues of $30,000,000

Q71: Daniel Corporation,which has a fiscal year ending

Q74: Cherokee Company reported consolidated revenue of $90,000,000