Short Answer

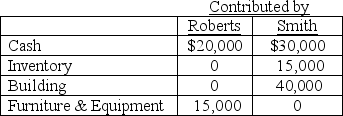

Roberts and Smith drafted a partnership agreement that lists the following assets contributed at the partnership's formation:

The building is subject to a mortgage of $10,000,which the partnership has assumed.The partnership agreement also specifies that profits and losses are to be distributed evenly.What amounts should be recorded as capital for Roberts and Smith at the formation of the partnership?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The terms of a partnership agreement provide

Q3: When a new partner is admitted into

Q16: In the LMN partnership,Lynn's capital is $60,000,Marty's

Q22: The JPB partnership reported net income of

Q26: The PQ partnership has the following plan

Q27: In the AD partnership,Allen's capital is $140,000

Q29: Which of the following accounts could be

Q51: In the AD partnership,Allen's capital is $140,000

Q57: When a new partner is admitted into

Q63: In the JK partnership,Jacob's capital is $140,000,and