Essay

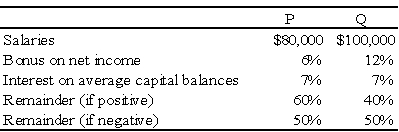

The PQ partnership has the following plan for the distribution of partnership net income (loss):

Required:

Calculate the distribution of partnership net income (loss)for each independent situation below (for each situation,assume the average capital balance of P is $140,000 and of Q is $240,000).

1.Partnership net income is $360,000.

2.Partnership net income is $240,000.

3.Partnership net loss is $40,000.

Problem 74 (continued):

Correct Answer:

Verified

Situation 1: Net income is $36...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The terms of a partnership agreement provide

Q3: When a new partner is admitted into

Q22: The JPB partnership reported net income of

Q24: Roberts and Smith drafted a partnership agreement

Q29: Which of the following accounts could be

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q51: In the AD partnership,Allen's capital is $140,000

Q57: When a new partner is admitted into

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q63: In the JK partnership,Jacob's capital is $140,000,and