Multiple Choice

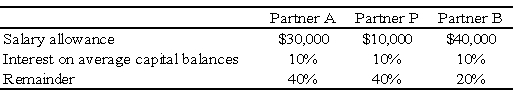

The APB partnership agreement specifies that partnership net income be allocated as follows:

Average capital balances for the current year were $50,000 for A, $30,000 for P, and $20,000 for B.

-Refer to the information given.Assuming a current year net income of $50,000,what amount should be allocated to each partner?

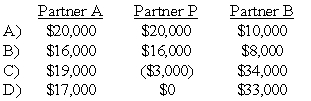

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In the JK partnership,Jacob's capital is $140,000,and

Q5: In the JK partnership,Jacob's capital is $140,000,and

Q17: When the old partners receive a bonus

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q45: In the JK partnership, Jacob's capital is

Q47: Transferable interest of a partner includes all

Q49: On June 30,the balance sheet for the

Q52: The ABC partnership had net income of

Q58: In the AD partnership,Allen's capital is $140,000

Q61: In the ABC partnership (to which Daniel