Multiple Choice

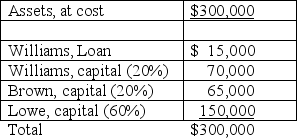

On June 30,the balance sheet for the partnership of Williams,Brown and Lowe,together with their respective profit and loss ratios,was as follows:

Williams has decided to retire from the partnership and by mutual agreement the assets are to be adjusted to their fair value of $360,000 at June 30.It was agreed that the partnership would pay Williams $102,000 cash for his partnership interest exclusive of his loan which is to be repaid in full.No goodwill is to be recorded in this transaction.After William's retirement,and before the loan is repaid,what are the capital account balances of Brown and Lowe,respectively?

A) $65,000 and $150,000

B) $72,000 and $171,000

C) $73,000 and $174,000

D) $77,000 and $186,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In the JK partnership,Jacob's capital is $140,000,and

Q5: In the JK partnership,Jacob's capital is $140,000,and

Q17: When the old partners receive a bonus

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q44: Jones and Smith formed a partnership with

Q45: In the JK partnership, Jacob's capital is

Q47: Transferable interest of a partner includes all

Q50: The APB partnership agreement specifies that partnership

Q52: The ABC partnership had net income of

Q58: In the AD partnership,Allen's capital is $140,000