Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

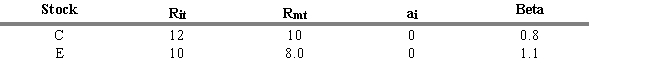

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 5.1. What is the abnormal rate of return for Stock E when you consider its systematic risk measure (beta) ?

A) 2.0 percent

B) 1.2 percent

C) 4.0 percent

D) -1.05 percent

E) -8.5 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q41: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q42: According to the semistrong-form efficient market hypothesis,

Q43: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q44: The weak form of the efficient market

Q45: Confirmation bias refers to the situation in

Q47: The weak-form efficient market hypothesis assumes all

Q48: In order to confirm the weak-form efficient

Q49: The ratio of the price of a

Q50: According to Dow Theory, a major market<br>A)

Q51: Fusion investing is the integration of two