Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

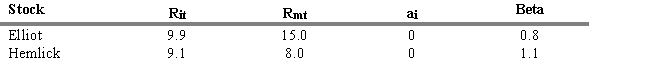

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 5.3. What is the abnormal rate of return for Elliot when you consider its systematic risk measure (beta) ?

A) -2.10 percent

B) -2.00 percent

C) 5.20 percent

D) 14.10 percent

E) 3.00 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q38: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q39: The results of studies that have looked

Q40: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q41: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q42: According to the semistrong-form efficient market hypothesis,

Q44: The weak form of the efficient market

Q45: Confirmation bias refers to the situation in

Q46: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q47: The weak-form efficient market hypothesis assumes all

Q48: In order to confirm the weak-form efficient