Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

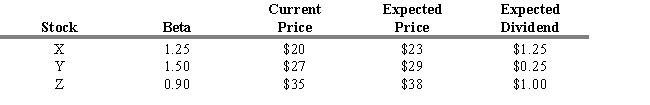

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.2. What are the expected (required) rates of return for the three stocks (in the order X, Y, Z) ?

A) 16.50 percent, 5.50 percent, 22.00 percent

B) 9.25 percent, 10.5 percent, 7.5 percent

C) 21.25 percent, 8.33 percent, 11.43 percent

D) 6.20 percent, 2.20 percent, 8.20 percent

E) 15.00 percent, 3.50 percent, 7.30 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q111: All of the following are assumptions of

Q117: Overall, the correlation coefficients of industries to

Q118: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q120: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q121: Cho, Elton, and Gruber tested the APT

Q123: USE THE INFORMATION BELOW FOR THE

Q124: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q125: The equation for the single-index market model

Q126: Assume the risk-free rate is 4.5 percent

Q127: USE THE INFORMATION BELOW FOR THE FOLLOWING