Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

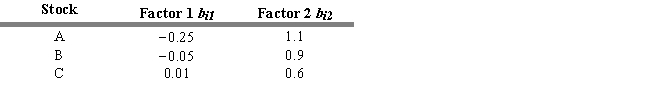

Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return ( 0) = .025 and the risk premiums for the two factors are ( 1) = .12 and ( 0) = .10.

-Refer to Exhibit 7.10. Suppose that you know that the prices of stocks A, B, and C will be $10.95, 22.18, and $30.89, respectively. Based on this information,

A) all three stocks are overvalued.

B) all three stocks are undervalued.

C) stock a is undervalued, stock b is properly valued, and stock c is undervalued.

D) stock a is undervalued, stock b is properly valued, and stock c is overvalued.

E) stock a is overvalued, stock b is overvalued, and stock c is undervalued.

Correct Answer:

Verified

Correct Answer:

Verified

Q111: All of the following are assumptions of

Q118: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q120: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q121: Cho, Elton, and Gruber tested the APT

Q122: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q124: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q125: The equation for the single-index market model

Q126: Assume the risk-free rate is 4.5 percent

Q127: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q128: USE THE INFORMATION BELOW FOR THE FOLLOWING