Multiple Choice

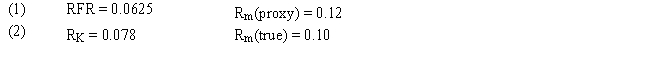

Assume that as a portfolio manager the beta of your portfolio is 1.15 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2.53 percent lower

B) 3.85 percent lower

C) 2.53 percent higher

D) 4.4 percent higher

E) 3.85 percent higher

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Consider the following list of risk factors:

Q39: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q40: Assume that the risk-free rate of return

Q41: In the APT model, the identity of

Q42: In a microeconomic (or characteristic)-based risk factor

Q44: The variance of returns for a risky

Q45: The planning period for the CAPM is

Q46: USE THE INFORMATION BELOW FOR THE

Q47: The expected return for a stock, calculated

Q48: The APT does not require a market