Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

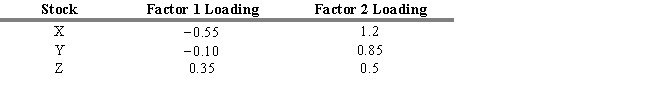

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. Assume that you wish to create a portfolio with no net wealth invested. The portfolio that achieves this has 50 percent in stock X, -100 percent in stock Y, and 50 percent in stock Z. The weighted exposure to risk factor 1 for stocks X, Y, and Z are

A) 0.50, -1.0, 0.50.

B) -0.50, 1.0, -0.50.

C) 0.60, -0.85, 0.25.

D) -0.275, 0.10, 0.175.

E) 0.40, -0.75, 0.25.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: In the APT model, the identity of

Q42: In a microeconomic (or characteristic)-based risk factor

Q43: Assume that as a portfolio manager the

Q44: The variance of returns for a risky

Q45: The planning period for the CAPM is

Q47: The expected return for a stock, calculated

Q48: The APT does not require a market

Q49: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q50: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q51: Assume that as a portfolio manager the