Multiple Choice

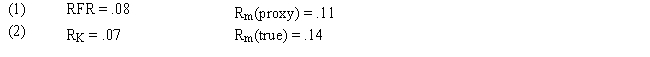

Assume that as a portfolio manager the beta of your portfolio is 1.3 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 4.2 percent lower

B) 3.6 percent lower

C) 3.8 percent lower

D) 4.2 percent higher

E) 3.6 percent higher

Correct Answer:

Verified

Correct Answer:

Verified

Q51: Assume that as a portfolio manager the

Q52: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q53: The expected return for Zbrite stock calculated

Q54: USE THE INFORMATION BELOW FOR THE

Q55: If an incorrect proxy market portfolio such

Q57: USE THE INFORMATION BELOW FOR THE

Q58: One approach for using multifactor models is

Q59: Calculate the expected return for D Industries,

Q60: The "true" market portfolio is unknown.

Q98: A completely diversified portfolio would have a